Aveling Barford Ltd v Perion Ltd [1989] BCLC 626

Citation:Aveling Barford Ltd v Perion Ltd [1989] BCLC 626

Link to case on WorldLII (reference).

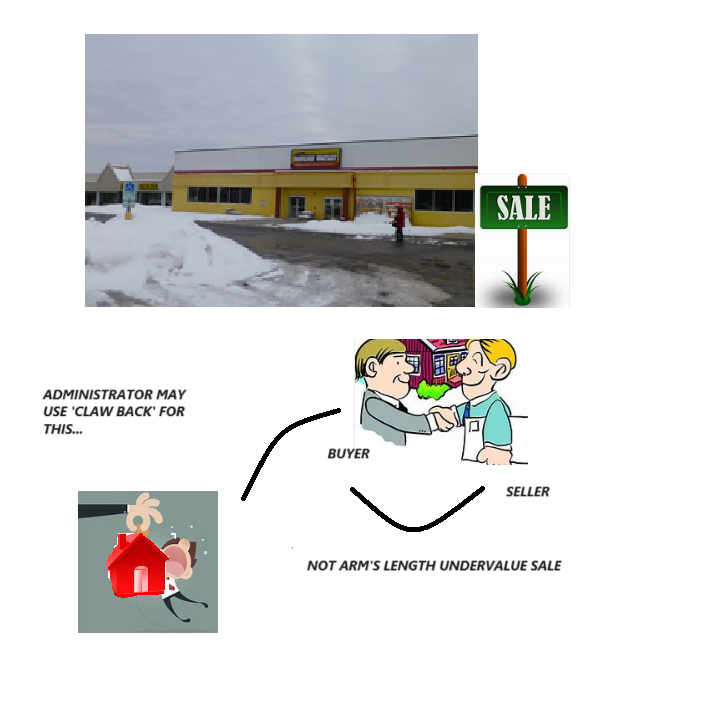

Rule of thumb 1: When is a business considered legally insolvent? When the value of all its assets & forecast profits add up to less than its debts – any transactions beyond this point which were ‘undervalue’ can be recouped by an administrator/liquidator.

Rule of thumb 2: What is an arm’s length sale? This is when an asset is sold for close to its value. When it not close to its value it is considered to be ‘undervalue’ and may be able to be recouped by administrators/liquidators – 25% of the value is considered well undervalue.

Rule of thumb 3: Can law journals be relied on as sources of law? Yes, they can be particularly effective if there is a source of law which there is scope for interpretation over. Law journals are able to be referred to in Court cases as a secondary source of law, particularly if they provide a more extensive coverage of legal source than that provided by the litigants in the case or other Institutional Writers.

Judgment:

Aveling Bradford owned property worth £1.5 million, and not long before the company went into liquidation, this property was sold to Perion Ltd, a shareholder in the company, for £350,000. The liquidators of Aveling Bradford sought to have this transfer of property declared this distribution as an unlawful reduction of capital that could be recouped. The Court held that this was sufficiently below the true market value to be considered an unlawful, undervalue transaction.

Ratio-decidendi:

‘The rule that capital may not be returned to shareholders is a rule for the protection of creditors and the evasion of the rule falls within what I think Slade LJ had in mind when he spoke of fraud on creditors. held – 24. The essential issue then, is how the sale by PPC of its shareholding in YMS is to be characterised. That is how it was put by Sir Owen Dixon CJ in Davis Investments Pty Ltd v Commissioner of Stamp Duties (New South Wales) (1958) 100 CLR 392, 406 (a case about a company reorganisation effected at book value in which the High Court of Australia were divided on what was ultimately an issue of construction on a stamp duty statute). The same expression was used by Buxton LJ in MacPherson v European Strategic Bureau Ltd [2000] 2 BCLC 683, para 59. The deputy judge did not ask himself (or answer) that precise question. But he did (at paras 39-41) roundly reject the submission made on behalf of PPC that there is an unlawful return of capital "whenever the company has entered into a transaction with a shareholder which results in a transfer of value not covered by distributable profits, and regardless of the purpose of the transaction". A relentlessly objective rule of that sort would be oppressive and unworkable. It would tend to cast doubt on any transaction between a company and a shareholder, even if negotiated at arm's length and in perfect good faith, whenever the company proved, with hindsight, to have got significantly the worse of the transaction. 25. In the Court of Appeal Mummery LJ developed the deputy judge's line of thought into a more rounded conclusion (para 30):"In this case the deputy judge noted that it had been accepted by PPC that the sale was entered into in the belief on the part of the director, Mr Moore, that the agreed price was at market value. In those circumstances there was no knowledge or intention that the shares should be disposed of at an undervalue. There was no reason to doubt the genuineness of the transaction as a commercial sale of the YMS1 shares. This was so, even though it appeared that the sale price was calculated on the basis of the value of the properties that was misunderstood by all concerned." 26. In seeking to undermine that conclusion Mr Collings QC (for PPC) argued strenuously that an objective approach is called for. The same general line is taken in a recent article by Dr Eva Micheler commenting on the Court of Appeal's decision, "Disguised Returns of Capital – An Arm's Length Approach," [2010] CLJ 151. This interesting article refers to a number of cases not cited to this court or to the courts below, and argues for what the author calls an arm's length approach.27. If there were a stark choice between a subjective and an objective approach, the least unsatisfactory choice would be to opt for the latter. But in cases of this sort the court's real task is to inquire into the true purpose and substance of the impugned transaction. That calls for an investigation of all the relevant facts, which sometimes include the state of mind of the human beings who are orchestrating the corporate activity. 28. Sometimes their states of mind are totally irrelevant. A distribution described as a dividend but actually paid out of capital is unlawful, however technical the error and however well-meaning the directors who paid it. The same is true of a payment which is on analysis the equivalent of a dividend, such as the unusual cases (mentioned by Dr Micheler) of In re Walters' Deed of Guarantee [1933] Ch 321 (claim by guarantor of preference dividends) and Barclays Bank plc v British & Commonwealth Holdings plc [1996] 1 BCLC 1 (claim for damages for contractual breach of scheme for redemption of shares). Where there is a challenge to the propriety of a director's remuneration the test is objective (Halt Garage), but probably subject in practice to what has been called, in a recent Scottish case, a "margin of appreciation": Clydebank Football Club Ltd v Steedman 2002 SLT 109, para 76 (discussed further below). If a controlling shareholder simply treats a company as his own property, as the domineering master-builder did in In re George Newman & Co Ltd [1895] 1 Ch 674, his state of mind (and that of his fellow-directors) is irrelevant. It does not matter whether they were consciously in breach of duty, or just woefully ignorant of their duties. What they do is enough by itself to establish the unlawful character of the transaction. 29. The participants' subjective intentions are however sometimes relevant, and a distribution disguised as an arm's length commercial transaction is the paradigm example. If a company sells to a shareholder at a low value assets which are difficult to value precisely, but which are potentially very valuable, the transaction may call for close scrutiny, and the company's financial position, and the actual motives and intentions of the directors, will be highly relevant. There may be questions to be asked as to whether the company was under financial pressure compelling it to sell at an inopportune time, as to what advice was taken, how the market was tested, and how the terms of the deal were negotiated. If the conclusion is that it was a genuine arm's length transaction then it will stand, even if it may, with hindsight, appear to have been a bad bargain. If it was an improper attempt to extract value by the pretence of an arm's length sale, it will be held unlawful. But either conclusion will depend on a realistic assessment of all the relevant facts, not simply a retrospective valuation exercise in isolation from all other inquiries. 30. Pretence is often a badge of a bad conscience. Any attempt to dress up a transaction as something different from what it is likely to provoke suspicion. In Aveling Barford there were suspicious factors, such as Dr Lee's surprising evidence that he was ignorant of the Humberts' valuation, and the dubious authenticity of the "overage" document. But in the end the disparity between the valuations and the sale price of the land was sufficient, by itself, to satisfy Hoffmann J that the transaction could not stand... 33. In this case there are concurrent findings that the sale of YMS1 to Moorgarth was a genuine commercial sale. The contrary was not pleaded or put to Mr Moore in cross-examination. I would dismiss this appeal’. (Lord Walker)

‘This was so, even though it appeared that the sale price was calculated on the basis of the value of the properties that was misunderstood by all concerned." 26. In seeking to undermine that conclusion Mr Collings QC (for PPC) argued strenuously that an objective approach is called for. The same general line is taken in a recent article by Dr Eva Micheler commenting on the Court of Appeal's decision, "Disguised Returns of Capital – An Arm's Length Approach," [2010] CLJ 151’, Lord Walker

Warning: This is not professional legal advice. This is not professional legal education advice. Please obtain professional guidance before embarking on any legal course of action. This is just an interpretation of a Judgment by persons of legal insight & varying levels of legal specialism, experience & expertise. Please read the Judgment yourself and form your own interpretation of it with professional assistance.