IRC v Von Glehn, 1920 [1920] 2 KB 5 53

Citation:IRC v Von Glehn, 1920 [1920] 2 KB 5 53

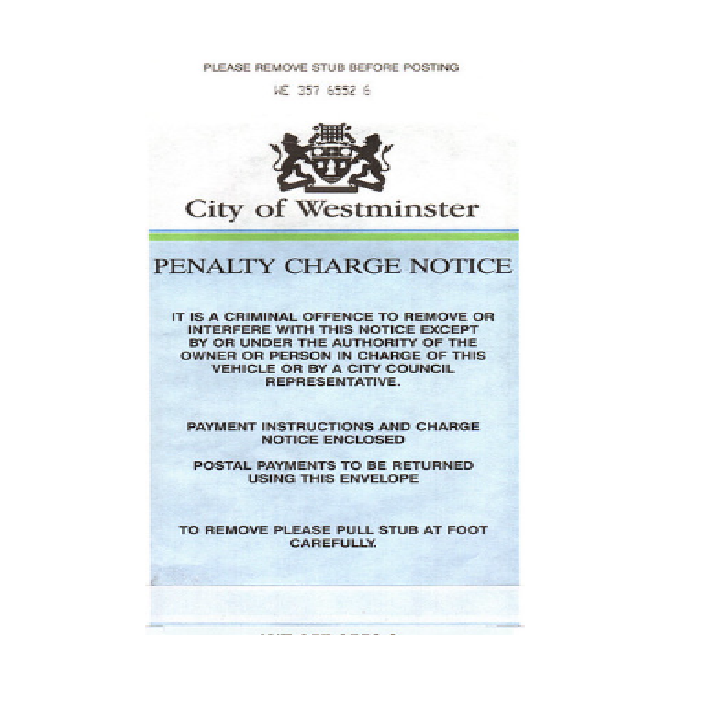

Rule of thumb:If a business sustains penalties/fine, are these deductible tax expenses? No, Where someone is found liable for fines these are not tax deductible and they are not deemed to meet the ‘wholly and exclusively’ test.

Judgment:

‘Were these penalties an expenditure necessary to earn the profits? Were they paid for the purpose of earning the profits? The answer seems to me to be obvious, that they were not; they were unfortunate incidents which followed after the profits had been earned.’ Scrutton LJ

Warning: This is not professional legal advice. This is not professional legal education advice. Please obtain professional guidance before embarking on any legal course of action. This is just an interpretation of a Judgment by persons of legal insight & varying levels of legal specialism, experience & expertise. Please read the Judgment yourself and form your own interpretation of it with professional assistance.