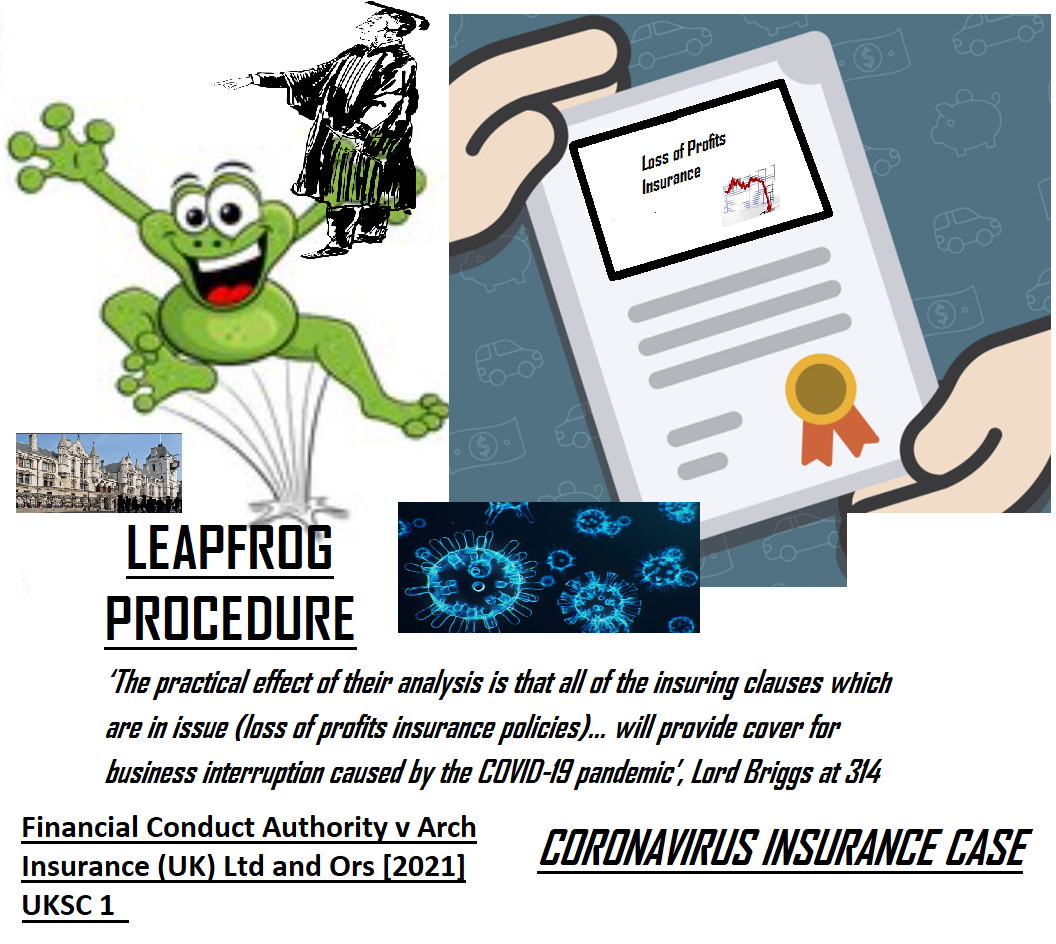

Financial Conduct Authority v Arch Insurance (UK) Ltd and Ors [2021] UKSC 1

Citation:Financial Conduct Authority v Arch Insurance (UK) Ltd and Ors [2021] UKSC 1.

Subjects invoked: 13. 'Procedure'.69. 'Insurance'.

Rule of thumb:Can people with a ‘loss of business profit’ insurance claim from insurers for loss of profits during coronavirus? Can people with property insurance claim? What type of case can use leapfrog procedure? This was the ‘coronavirus’ insurance case. The first legal matter addressed in this case was a procedural one. It was confirmed that where there is a legal matter of pressing societal importance that affects many people, like coronavirus, then this is appropriate for what is called ‘leapfrog procedure’, with every possible effort being made to ensure its swift passage through the Court process – firstly in terms of having the trial as efficiently as possible to establish the facts, and then bypassing the Court of Appeal to have an authoritative opinion on the legalities of the matter. This is the system that it is to be used for cases of major societal importance. Secondly, the Court affirmed that it is only people with ‘loss of business profits’ insurance policies who can claim for losses made during the coronavirus pandemic. In its reasoning, the Court also affirmed the simplified 3 part approach is adopted in all insurance law claims, no matter the size, scale or importance. Firstly, the ‘cause of a loss’ must be ascertained, secondly, a person must have an ‘insurance policy’ that can potentially cover them for this type of loss, with an overarching, common sense and over-sighted approach being adopted to points one and two in order to broadly set the framework for the debate, and thirdly, the appropriate ‘clauses’ in this policy must only then be construed carefully with a great focus on the detail.

Background facts:

The facts of this case concerned insurers’ liability under 2 different types of policies - ‘loss of business profit’ insurance policies, as well as general ‘property insurance’ policies, for losses caused by the ‘coronavirus’ and its subsequent regulations introducing a ‘lockdown’ across society.

To cut a long story short, the Court held that only organisations with ‘loss of business profits’ insurance policies could claim for loss of profits during the pandemic.

Judgment:

The Financial Conduct Authority represented people who had these types of policies as the ‘test case’. This was a Judgement comprising 112 pages covering many legal issues, and there was even a conscious effort made to keep this Judgement as concise as possible whilst not comprising a full statement of the material and surrounding facts, as well a full statement of the underpinning fundamental points of law as well as in-point legal matters. 3 clauses on these 2 policies were largely – (i) ‘disease clauses’ under ‘loss of profit policies’, (ii) ‘trends clauses’ on ‘loss of profit policies’, (iii) ‘prevention of access and hybrid clauses’ on property policies, and the underlying issue of ‘causation’. In terms of the underlying issue of causation it was held that if there was a case of coronavirus within 25 miles of the business, this meant ‘disease’ was the cause of the lockdown, rather than new, preventative government regulations – this meant that every business in the UK was covered as there were cases in every corner of the UK. In terms of ‘loss of profit policies’ with ‘disease clauses’, if there was a case within 25 miles of the business then the business would generally be covered, subject to some exceptions depending on the exact wording of the policy. In terms of ‘trend clauses’, clauses that ensure downturns in profits sustained across a whole sector are not covered as loss of profits, it was held that these did not apply to prevent the insurers from having liability. In terms of property policies with ‘prevention of access and hybrid’ clauses, it was generally held that people for the most part people would not be covered, subject to some exceptions depending on the exact wording of the policy or exceptional situations such as the police cordoning off their building.

Ratio-decidendi:

‘The practical effect of their analysis is that all of the insuring clauses which are in issue on the appeal to this court (not including those clauses where the issues appealed by the FCA are academic) will provide cover for business interruption caused by the COVID-19 pandemic, and that the trends clauses will not cut it down in the calculation of the amounts payable’, Lord Briggs at 314, ‘The interpretation which makes best sense of the clause, in our view, is to regard each case of illness sustained by an individual as a separate occurrence. On this basis there is no difficulty in principle and unlikely in most instances to be difficulty in practice in determining whether a particular occurrence was within or outside the specified geographical area... The court below (at para 281 of the judgment) discussed an example, based on a different limb of the Hiscox public authority clause wording, of inability to use restaurant premises due to restrictions imposed by the local authority following the discovery of vermin dislodged from a nearby building site. The court said that, to interpret the indemnity as limited to loss that would not have been suffered but for the forced closure of the premises “would render the cover largely illusory, as insurers would argue that, as no one is likely to want to eat at a restaurant infested by vermin, all or most of the business interruption loss would have been suffered in any event.” The court considered that such cover “cannot have been intended and is not what we consider would reasonably be understood to be what the parties had agreed to”. We agree and consider the underlying explanation to be that, where insurance is restricted to particular consequences of an adverse event (such as in this example the discovery of vermin in the premises) the parties do not generally intend other consequences of that event, which are inherently likely to arise, to restrict the scope of the indemnity’, Lord Hamblen and Lord Leggatt at 69, and, 238-239,

‘39. At a later case management conference Hiscox Action Group (“the Hiscox Interveners”) and the Hospitality Insurance Group Action were permitted to join the proceedings as interveners. 40. There were 21 “lead” policies considered by the court below: one issued by Arch; one issued by Argenta; two issued by Ecclesiastical (“Ecclesiastical 1.1” and “Ecclesiastical 1.2”); four issued by Hiscox (“Hiscox 1”, “Hiscox 2”, “Hiscox 3” and “Hiscox 4”); three issued by MS Amlin (“MSA 1”, “MSA 2” and “MSA 3”); three issued by QBE (“QBE 1”, “QBE 2” and “QBE 3”); five issued by RSA (“RSA 1”, “RSA 2.1”, “RSA 2.2”, “RSA 3” and “RSA 4”); and two issued by Zurich (“Zurich 1” and “Zurich 2”). 41. The trial took place remotely over eight days between 20 and 30 July 2020. As is permitted under the Test Case Scheme and given the importance of the issues raised, the case was heard by a court of two judges. They were Flaux LJ, a judge of the Court of Appeal, and Butcher J, a High Court judge authorised to sit in the Financial List. Both judges have extensive knowledge and experience of insurance law. 42. The joint judgment of the court was given on 15 September 2020. It is a very thorough judgment running to 580 paragraphs. On 2 October 2020, the court gave all parties permission to appeal and also certified that the appeals were suitable for the “leapfrog” procedure which enables an appeal in exceptional circumstances to bypass the Court of Appeal and proceed directly to the Supreme Court. The Supreme Court gave permission to appeal on 2 November 2020 and the appeal was heard over four days between 16 and 19 November 2020. 43. It is a testament to the success of the Test Case Scheme procedure that it will have enabled the important legal issues raised in this case to be finally decided following a trial and an appeal to the Supreme Court in just over seven months. It is hoped that this determination will facilitate prompt settlement of many of the claims Page 11 and achieve very considerable savings in the time and cost of resolving individual claims. 44. To achieve this an immense amount of work has been done by the legal teams of all the parties to the proceedings. They have also conducted the proceedings in a co-operative and constructive manner. Despite the tight time frame, the quality of the written and oral submissions has been of the highest order and all involved are to be complimented. The very able assistance that we have received from counsel has brought the issues raised on the appeals into clear focus’, Lord Hamblen and Lord Leggatt writing jointly at 39-44

Warning: This is not professional legal advice. This is not professional legal education advice. Please obtain professional guidance before embarking on any legal course of action. This is just an interpretation of a Judgment by persons of legal insight & varying levels of legal specialism, experience & expertise. Please read the Judgment yourself and form your own interpretation of it with professional assistance.